Binance, established in 2017, has rapidly become one of the world’s leading cryptocurrency exchanges, known for its robust platform and extensive range of services. Understanding the core mechanics of Binance is essential for users who want to navigate this ecosystem effectively and leverage its full potential.

At its foundation, Binance operates as a centralized exchange (CEX), which means it acts as an intermediary between buyers and sellers of cryptocurrencies. Unlike decentralized exchanges (DEXs), where transactions occur directly between users on a blockchain network, Binance facilitates trades through an internal order book system. This setup allows for high-speed transaction processing and liquidity management but requires users to trust the platform with their assets during trading.

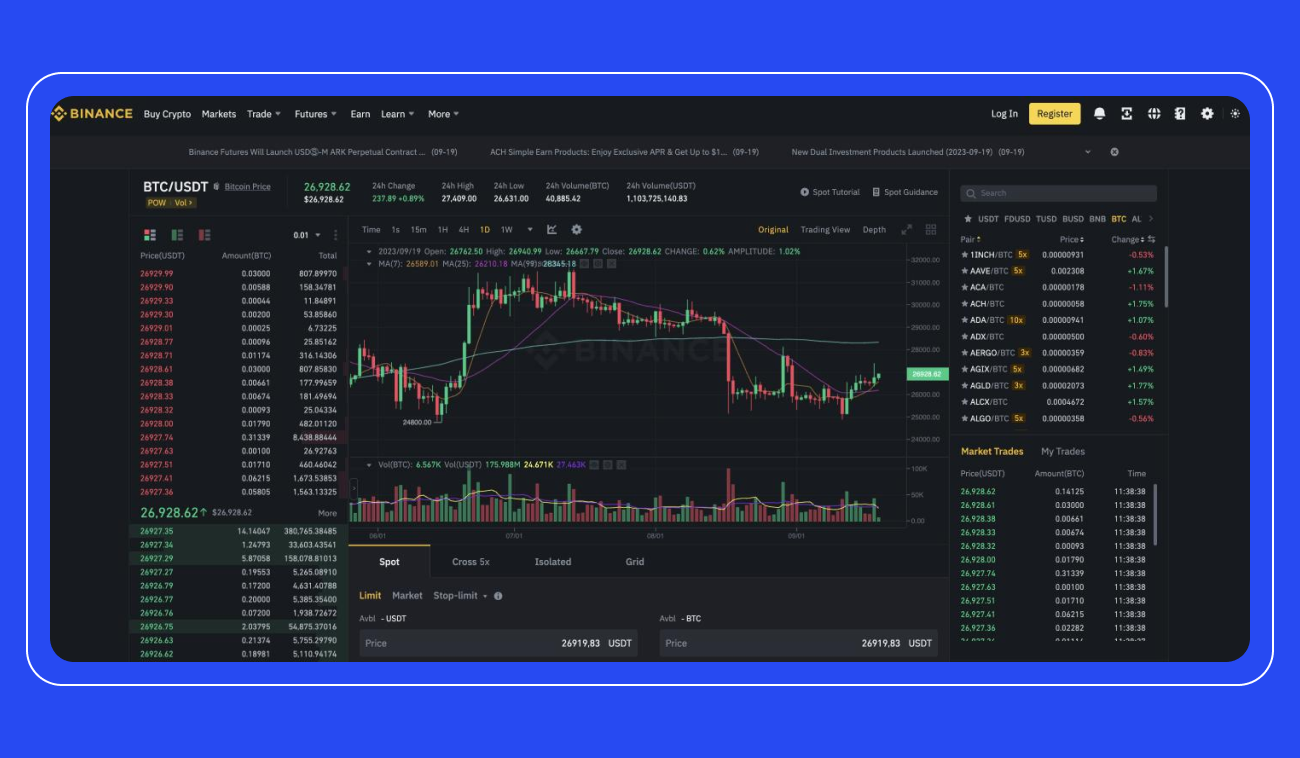

The primary mechanism behind Binance’s trading functionality is its matching engine. how this works in practice sophisticated algorithm matches buy orders with sell orders based on price and time priority. When a user places an order-whether it be a market order or limit order-the matching engine scans existing orders to find compatible counterparts. Market orders execute immediately at the best available price, while limit orders wait until predefined conditions are met. The efficiency of this engine enables Binance to handle millions of transactions per second, ensuring smooth operation even during periods of high market volatility.

Another critical aspect is Binance’s use of multiple trading pairs across numerous cryptocurrencies. By offering thousands of pairs-from mainstream coins like Bitcoin (BTC) and Ethereum (ETH) to emerging altcoins-Binance provides ample opportunities for diversification and arbitrage strategies within a single platform.

Security plays a vital role in maintaining user confidence on Binance. The platform employs advanced security measures such as two-factor authentication (2FA), withdrawal whitelist options, cold storage wallets for safeguarding funds offline, and regular security audits to mitigate risks from cyber threats.

Moreover, Binance incorporates a native utility token called BNB (Binance Coin). Initially launched as an ERC-20 token on Ethereum before migrating to its own blockchain called Binance Chain, BNB serves multiple purposes within the ecosystem: paying transaction fees at discounted rates, participating in token sales via Launchpad events, staking in various DeFi products offered by Binance Smart Chain (BSC), and more.

Beyond spot trading mechanics, Binance also supports futures contracts that allow traders to speculate on asset prices with leverage. These derivatives introduce additional complexity involving margin requirements and liquidation mechanisms designed to manage risk exposure effectively.

In summary, understanding how Binance functions involves grasping its centralized structure powered by an efficient matching engine; diverse asset offerings; strong emphasis on security protocols; integration of BNB token utilities; and expanded features like futures trading that cater both novice investors and professional traders alike. Mastery over these core components empowers users not only to trade confidently but also explore broader financial opportunities within the dynamic crypto landscape facilitated by Binance’s comprehensive infrastructure.